KOREA ELECTRIC POWER (KEP)·Q3 2025 Earnings Summary

KEPCO Q3 2025 Earnings

Executive Summary

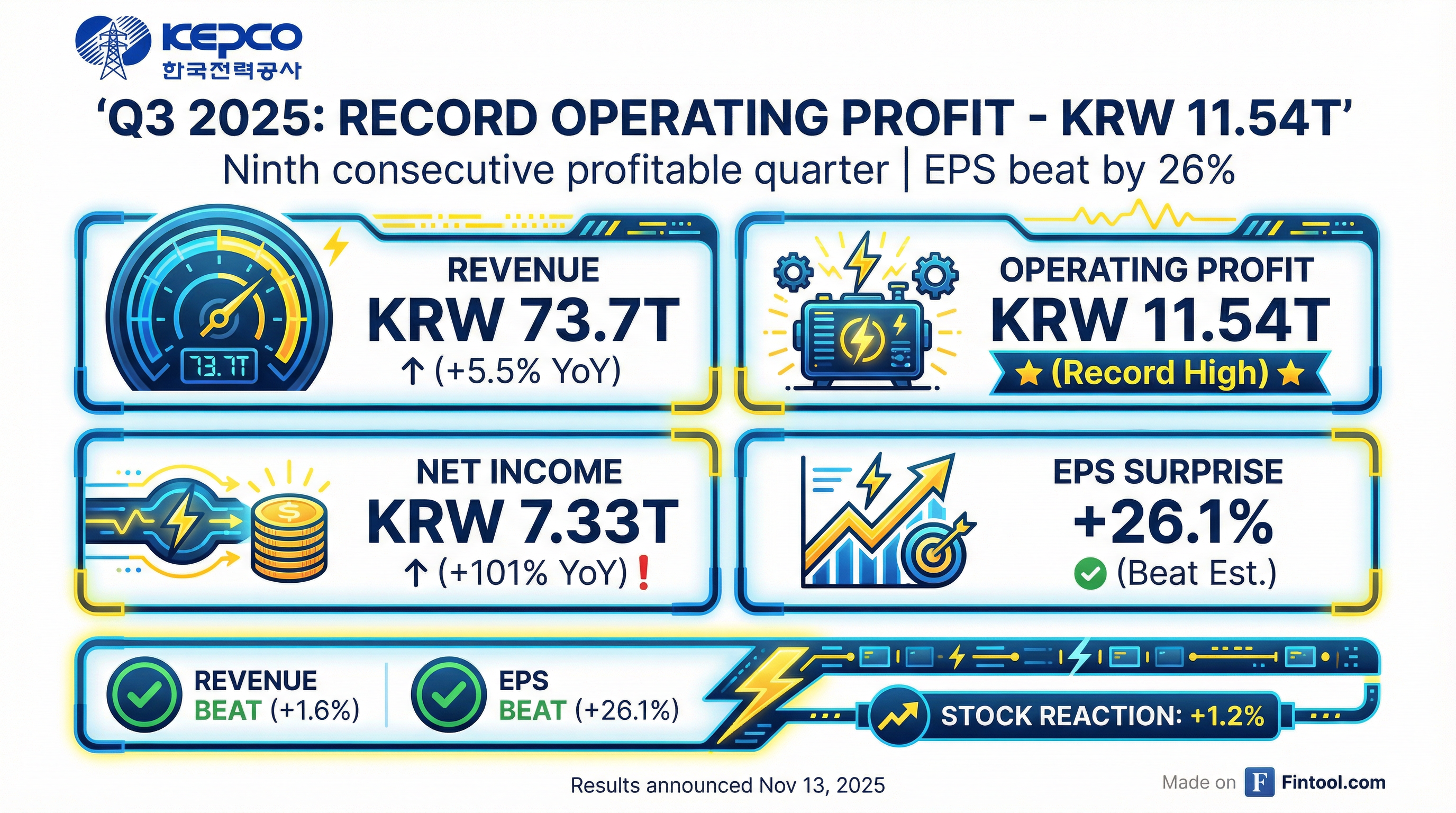

Korea Electric Power Corporation (KEPCO) delivered record quarterly operating profit of KRW 11.54 trillion in Q3 2025, marking its ninth consecutive profitable quarter . The turnaround from prior losses was driven by:

- Lower fuel costs (-16% YoY) amid stabilizing global energy prices

- Industrial tariff hike (+9.7%) implemented in October 2024

- Higher nuclear generation mix from new plant operations

The stock rose +1.2% on earnings day, extending its +154.5% YTD rally as the utility completes its dramatic financial recovery.

The Numbers

*Values retrieved from S&P Global

Beat/Miss Summary

*Values retrieved from S&P Global

Earnings History & Stock Performance

8-Quarter Beat/Miss Record

*Values retrieved from S&P Global

Beat Rate: Revenue 6/8 (75%) | EPS 7/8 (88%)

Financial Trends

Quarterly Financials (USD)

*Values retrieved from S&P Global

Key Observations:

- EBITDA margin expanded to 33.1% in Q3 2025 — highest in 8 quarters

- Net income margin tripled YoY to 13.6%

- Total debt declined ~$11B from Q4 2023 levels

What Drove Results

✅ What Went Well

1. Fuel Cost Collapse (-16% YoY)

"Fuel cost is KRW 14 trillion 826 billion, down by 16%, and power purchase cost is KRW 26 trillion 606.3 billion, down by 0.8%, affected by fuel price changes."

2. Electricity Sales Growth

"Electricity sales revenue posted KRW 70 trillion 631.6 billion, accounting for 5.9% [growth]"

"Electricity sales volume in Q3 reached 419.9 TWh, up 0.4% YoY due to mostly the summer heat wave"

3. Nuclear Mix Expansion

"Our generation mix for nuclear went up due to the entry into operation of new nuclear power plants"

"Expected utilization rate by generation source for 2025 for nuclear is at the mid-to-high 80% range"

4. Lower Interest Expense

"Interest expenses down YOY by KRW 143.5 billion to post KRW 3 trillion 279.4 billion"

⚠️ Challenges & Risks

1. Demand Softness Expected

"For the full year of 2025, we project sales to go down slightly due to the impact of lower economic growth rate and also the impact of the downturn in the manufacturing sector"

2. Foreign Exchange Exposure

"In the case of KEPCO, for the most part, yes, we are exposed. We have an open position to the foreign exchange rate"

3. Tariff Uncertainty

"With expansion of the use of renewable energy and also to supply stable electricity for the advanced industries... there is a need to make further investments into our power grid. And so yes, it is necessary to raise the tariffs"

Management Commentary

On Nuclear Power Expansion (U.S. Market)

"The Trump administration in the United States has announced a policy to increase nuclear power generation within the United States, and they are looking forward to cooperating with KEPCO and Team Korea in this area. We are looking into various options in how we can participate in the U.S. nuclear market."

On HVDC Project Timeline

"The first phase of the project is expected to be completed by October of 2026, and the second phase of the construction is expected to be completed by December of 2027. Once the HVDC project is completed, then it will be providing an additional 4 gigawatts of transmission capacity."

On Overseas Nuclear Bids

"For the Asian market, we are carrying out activities to win nuclear power plant orders in Vietnam. And in the case of the Middle East, we have participated in the bidding process of a nuclear power plant project in Saudi Arabia."

On Shareholder Returns

"The most important aspect of shareholder return would be, of course, the dividend policy. And the dividend policy would take into consideration the net profit of that year."

Q&A Highlights

Localized Marginal Pricing System

Q: When will the new wholesale/retail pricing systems be introduced?

"By May of 2024, it has been decided that within the year 2025, the wholesale system will be introduced, and that by 2026, the retail system will be introduced... we will be completing the research that has been commissioned to outside organizations regarding this issue by the month of February of next year."

Emissions Trading Scheme

Q: How will the new ETS period affect GenCos?

"On the 10th of November, the fourth plan period ETS has been announced and finalized, and it is expected that for the GenCos, they will be subjected to 10%-50% of the paid allocation. With regards to this, we will make sure that these charges are fully reflected in our environmental charges."

Uranium Enrichment Opportunity

Q: Will Korea be allowed to enrich/reprocess uranium under the new U.S. agreement?

"Up until now, it has not been allowed for Korea to engage in uranium enrichment within Korea. However, we are looking forward to this situation being resolved based on the recent agreement. However, going forward, the exact details of how this will be brought about is something that has not yet been finally determined."

Stock Performance

Post-Earnings Stock Moves (Historical)

Key Takeaways

-

Record profitability achieved — KRW 11.54T operating profit is the highest quarterly figure in company history

-

Turnaround complete — Nine consecutive profitable quarters after massive losses in 2021-2023

-

Fuel cost tailwind — 16% YoY decline in fuel costs remains the primary margin driver

-

Nuclear expansion accelerating — Higher nuclear mix, U.S. market entry exploration, and uranium enrichment opportunities

-

Demand headwinds ahead — Management expects slight sales decline due to economic softness

-

Grid investment needs — HVDC project and renewable integration require continued capex

Links

- Company Profile: /app/research/companies/KEP

- Transcript: /app/research/companies/KEP/documents/transcripts/Q3-2025

- Prior Earnings: /app/research/companies/KEP/earnings/Q2-2025